Insights

Want these insights and updates straight to your inbox? Subscribe to our monthly newsletter.

CHECK OUT OUR CLIMATE IMPACT REPORTS:

Better together like tacos and tequila

Last month we shared that our portfolio companies mitigated one million tonnes of CO2e! This is a big milestone, but it’s also a small fraction of the 50 billion tonnes of CO2e our society is producing annually. We … both the global ‘we’ and the Active Impact portfolio of companies … need to grow our emissions mitigation number aggressively to address our changing climate and keep global warming below 2.0 degrees.

Last month we shared that our portfolio companies mitigated one million tonnes of CO2e! This is a big milestone, but it’s also a small fraction of the 50 billion tonnes of CO2e our society is producing annually. We … both the global ‘we’ and the Active Impact portfolio of companies … need to grow our emissions mitigation number aggressively to address our changing climate and keep global warming below 2.0 degrees.

During our diligence process, we scrutinize the strength of the link between emissions reduction and revenue growth. If the link’s not clear, we don’t invest. Enterprise revenue growth is a key area of support we provide our management teams post-investment, which in turn increases impact. We provide everything from one-on-one advice to founders who are navigating their first enterprise sales conversion to actively placing key talent in revenue generation roles. In February we placed Mike Watson as CRO of Flair, who previously built a $100M smart lighting and electrical products business—very analogous to the work he’ll be doing at Flair.

This graph is pulled from a recent investor report to illustrate the revenue/impact link in action. The company name is redacted for confidentiality.

In venture capital, doubling revenues year-over-year in early days is a strong representation of demand, and tripling year-over-year is seen as a benchmark for exceptional growth. Exponential revenue growth demonstrates real customer demand and shows that a given company has the operational skill to execute on that demand. While Fund II is early in its performance and emissions mitigation journey, the 2023 numbers are in and they are strong. 37% of our Fund II companies grew revenues at least 3x over last year and almost 70% of our companies are at least doubling YoY. This certainly gives us confidence that our companies that come to market will find receptive audiences for financing and significantly increase share prices. It also makes us particularly excited for our impact numbers as those revenue growth numbers translate to real emissions reduction.

They say the first million is the hardest

We are so excited to share that we recently crossed one of many major milestones to come—our portfolio companies have now mitigated a collective one million tonnes of carbon dioxide equivalent emissions. On Feb. 13 our whole team hosted ~50 investors and four local founders at our second in-person Annual General Meeting (AGM) on Grouse Mountain and we used this important milestone as the theme of the event.

We are so excited to share that we recently crossed one of many major milestones to come—our portfolio companies have now mitigated a collective one million tonnes of carbon dioxide equivalent emissions. On Feb. 13 our whole team hosted ~50 investors and four local founders at our second in-person Annual General Meeting (AGM) on Grouse Mountain and we used this important milestone as the theme of the event. Investors flew in from Toronto, Montreal and Ottawa (representing our largest institutional investors) to see presentations from our team on 2023 performance, learn about the macro VC and climate tech market from RBCx and see what founders from Clir, Railvision and Othersphere are building.

Funds are expected or required to hold AGM’s, but like everything we do, we first satisfy the need but then always try to add elements of surprise, personality, togetherness and joy. Our 32-company portfolio (including four exited) provides a model of how early-stage companies can drive meaningful climate progress and venture scale. In the global scheme of things, one million tonnes of CO2e is tiny, but we’re just hitting our stride and these companies (and many more like them) have millions more tonnes of potential in their near future.

Gimme gimme never gets

January isn’t just for trying new workout routines, going vegan or taking a booze-break—in the world of venture funds, it’s also the beginning of reporting season. The start of the new year means that we, like every other fiduciary, are looking back at the prior year to see how we did so that we can report to our stakeholders. And by how “we” did, we mean both us and our portfolio companies.

January isn’t just for trying new workout routines, going vegan or taking a booze-break—in the world of venture funds, it’s also the beginning of reporting season. The start of the new year means that we, like every other fiduciary, are looking back at the prior year to see how we did so that we can report to our stakeholders. And by how “we” did, we mean both us and our portfolio companies.

It’s obvious that we rigorously measure both financial and impact performance, but what’s not as obvious is just how much work that is … for us and also for every company we invest in. When a company takes money from investors (just like when we take investments from LPs) they agree to a layer-cake of reporting obligations. For the most part, those obligations are satisfied by simple accounting systems—but in the case of impact measurement there isn’t one ‘Generally Accepted Accounting Principle’, so often each investor will have their own requests based on what they care about

Here’s a little peek under the hood of what we collect at year end:

Financial statements, cap table and budget

Company specific unit economics and growth performance indicators

Company specific impact metrics to assess the tonnes of CO2 equivalent, clean energy generated or waste mitigated, plus any secondary impacts created by the product

Workforce diversity data

… which informs our deployment strategy, post-investment support and reporting cycle, shown (simplified) here:

We know it’s a lot, but that’s why we take a lot of effort to both ease the burden on companies AND make the exercise as valuable for them as it is for us. Everything listed above comprises our annual investor reports, our public Climate Impact Report, our internal post-investment support strategy, the content of our AGM and the baseline for our quarterly investor updates (not to mention this newsletter). We manage people’s money—we make sure they’re informed.

And, to keep things interesting for our investors we switch up the AGM format every year. Last year we held a large event concurrent to our first Founder Summit and had noted climate activist Bill McKibben speak. This year, we’re creating a showcase of our portfolio companies by compiling a video that features an insider look at each company’s product, the challenges they’re facing and how they’re positioning themselves to win. We are so excited to put the spotlight on our amazing founders so that our investors can better understand the underlying health and value of the portfolio. Many are also joining us and our investors live for both in-person and virtual events.

So this month we don’t have a Founder Spotlight for you. We’ve asked enough of our founders, and our team is busy cooking up a year’s worth of exciting news to share. We will get back to your regularly scheduled conversations with Mike, but for now we’ll just tease that we have an exciting announcement coming up next month.

We haven’t been this excited about a New Year since last year

Happy New Year! By almost all measures, 2023 was a tough year for the climate and for venture capital. Venture funding dropped significantly along with deal count and average deal size. We focused our company support (particularly at the beginning of the year) on healthy revenue pipelines, extending cash runway and reducing expenses in order to decrease the reliance on follow-on financings given the foreseen dip in investing activity.

Happy New Year! By almost all measures, 2023 was a tough year for the climate and for venture capital. Venture funding dropped significantly along with deal count and average deal size. We focused our company support (particularly at the beginning of the year) on healthy revenue pipelines, extending cash runway and reducing expenses in order to decrease the reliance on follow-on financings given the foreseen dip in investing activity. Though, we didn’t foresee a banking crisis with SVB that would shock the entire sector.

Happily, most of our companies continued to grow and several countered the fundraising slump with successful up-rounds, adding new investors. Fund I companies have grown revenue an average of 11X since our initial investment, Fund II companies grew revenue 12X in the past year, and seven companies closed financings at increased valuations with only one down round. We also bucked the downward VC fundraising trend by launching Fund III in April and announcing the initial close with $70M committed in October.

Climate change doesn’t care if markets are down or if it’s a tough economic environment for raising capital. In 2023 the whole world felt climate change—heat, fires, drought, floods—the urgency of deploying every viable climate tech solution was more acute than ever. So in addition to our annual round-up of our fund’s activities below, we’ve also included a selection of ‘holy shit’ moments in climate AND some important progress. Just as many of our companies and our fund showed meaningful momentum in the face of a stark reality, there was real, collective climate progress that we hope will motivate you like it does us.

January

Fund II investment #13 in Dispatch Goods

55% of the continental US is experiencing a drought

February

Launched our Earth Month Challenge with Genus Wealth Management, Spring, Pace Zero, Fulmer & Company and SVX

Antarctic sea ice shrank to a record low with only 66% the amount usually detected

March

ChopValue Series A

Run on Silicon Valley Bank triggers a cash emergency for multiple portfolio companies that Active jumps in to help, no companies suffered any permanent losses

April

Hosted our first in-person AGM and Founder Summit featuring Bill McKibben as a guest speaker

Earth Month Challenge collectively raised $22K for the Nature Conservancy of Canada

Canadian GHG Disclosure Standard comes into effect that requires government procurement to be in line with the Paris Agreement

May

Fund II investment #15 in Othersphere

Metafold follow-on investment

IEA reports that for every $1 invested in fossil fuels, ~$0.017is now going to clean energy

June

Released our 2nd Climate Impact Report

Future follow-on investment

Jaza follow-on investment

Clean Crop follow-on investment

Canada passes the Strengthening Environmental Protection for a Health Canada Act, enshrining the right to a healthy environment for the first time

July

Fund II investment #16 in Relyion

Sustain.Life follow-on investment

Hottest month ever recorded!

August

Carbon America follow-on investment

Optiwatt follow-on investment

One year anniversary of the Inflation Reduction Act that catalyzed 265 clean energy and manufacturing projects worth $100B+ in investment and 170,000 clean energy jobs

September

Encycle acquired by Instone Capital Partners

Lahaina wildfire is the deadliest wildfire in US history

6765 fires have burned 128.5M hectares across Canada–the worst wildfire season ever recorded

October

Fund III initial close with over $70M committed toward the $120M goal

SWTCH follow-on investment

IEA reports that 500 gigawatts of renewable energy capacity was added in the first half of the year accounting for 25% of all US electricity–a new record

California, the world’s 5th largest economy, mandates that companies make public disclosures of their scope 1, 2 and 3 emissions–Sustain.Life and Manifest Climate quickly feel the benefit from increased demand

November

Fund I exit #3 (still confidential)

National Automobile Dealer Association announces 1M EVs were sold in the US in 2023, up 50% over 2022. 1 in 5 cars sold is now an EV

December

Fund II investment #17 in JulesAI (our final company to be added to the Fund II portfolio)

COP28 agreed to ‘transition away’ from fossil fuels for the first time

Getting the right people on the (electric) bus

Hot off the heels of our Fund III initial close (more details below), we posted an open call to add another person to our investment team. The position is purposefully general—open to candidates across career stages. One might wonder why a VC that prides itself on its (unconventional) rockstar team, recruitment and hiring would put out such an atypical call to grow the team?

Hot off the heels of our Fund III initial close (more details below), we posted an open call to add another person to our investment team. The position is purposefully general—open to candidates across career stages. One might wonder why a VC that prides itself on its (unconventional) rockstar team, recruitment and hiring would put out such an atypical call to grow the team?

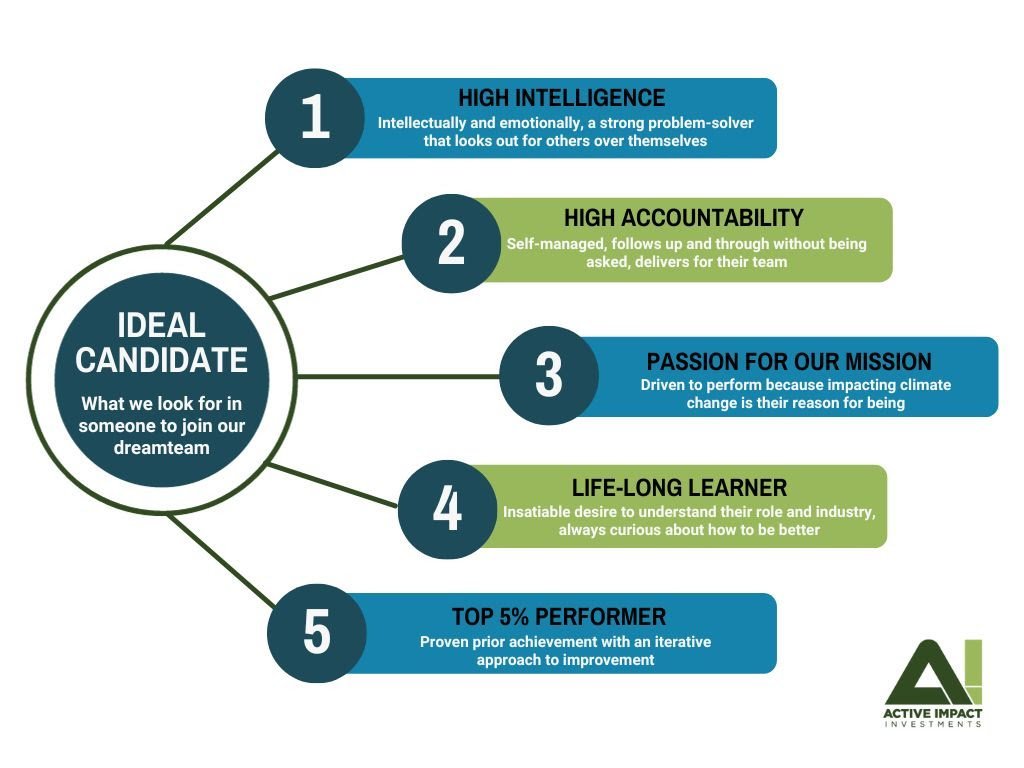

Our talent philosophy is curated over decades of professional recruitment and HR experience. Here is an inside look into our recipe for successful hiring:

Cast as wide a net as possible in search of the right persona, rather than looking to fill the tactical bullets of a job description.

There’s no such thing as a perfect candidate—the secret sauce is curating a team where personalities and intelligence coalesce to make each person the best they can be.

Create an avatar of the perfect person including the tendencies that align with the values of the organization and the skills gaps within the team.

Place a stronger emphasis on potential to create future value than prior directly transferable experience.

We apply a similar process for hiring our internal team as we do for identifying founders we think will win. To assess if a person has the five attributes of an ideal candidate, we ask situational questions and always drill into what the end result was. We look for answers that are direct in their quantification of performance.

If you or someone you know with investment experience embodies our five ideal attributes, we want to meet! We’re being conscious about running as inclusive a process as possible, so we ask that everyone expresses their interest through our talent page.

In climate, deadlines matter

We announced in June that we were going to raise our third fund targeting $120M. Shhh ... there will be a formal announcement in the coming weeks but we want our newsletter subscribers to be the first to hear. For now we can share that we exceeded our goal of 50% toward the final amount and have welcomed an absolutely incredible group of new institutional investors among many returning LPs.

We announced in June that we were going to raise our third fund targeting $120M. Shhh ... there will be a formal announcement in the coming weeks but we want our newsletter subscribers to be the first to hear. For now we can share that we exceeded our goal of 50% toward the final amount and have welcomed an absolutely incredible group of new institutional investors among many returning LPs.

Many of our peers and potential investors thought that we were nuts for attempting to raise money in this market. This is the worst time in 10 years to raise a fund—many allocators have stopped deploying funds or cut budgets significantly, and individuals/families are feeling the economic pinch. But our response was (and is) pretty simple:

What better time to have fresh, dry powder to invest than when other funds aren’t deploying? From our investors’ perspective it is beneficial for us to have access to more deals at better valuations, and from the founders perspective it makes a bleak environment more hospitable to growth.

The climate doesn’t care that markets are down! Climate change is accelerating faster than ever and funding solutions is both necessary and a huge opportunity. Shying away from a challenge is not in our DNA. Just because something is going to be hard doesn’t mean it isn’t worth doing. There are many key qualities we screen for in building our team—grit is near the top of the list.

Stay tuned for the public announcement and detail in an upcoming newsletter. For now, we’re immensely grateful to our community of investors, founders and supporters that have helped us reach this milestone.

Don't call it a comeback, I've been here for years

We are fully in the Climate Tech 2.0 era and things are vastly different from the first Clean Tech boom of the early 2000’s. We, like many investors raising funds to deploy into climate companies, spend considerable energy distinguishing the confluence of tailwinds in the current climate tech moment from the pitfalls of the previous era.

We are fully in the Climate Tech 2.0 era and things are vastly different from the first Clean Tech boom of the early 2000’s. We, like many investors raising funds to deploy into climate companies, spend considerable energy distinguishing the confluence of tailwinds in the current climate tech moment from the pitfalls of the previous era. Between 2006 and 2011, $25B in venture capital was invested in climate/clean tech companies and most of it did not generate the desired financial return. Clean Tech 1.0 was largely characterized as overly R&D and capital intensive with poor unit economics that took longer to materialize returns than investors could bear. But the investments of 1.0 helped create the positive conditions for our current climate tech generation.

Climate Tech 2.0 is buoyed by multiple factors that are all pushing the cost of climate tech adoption down … which is driving demand and the potential financial outcome up.

Technology and business models have advanced beyond science experiments. There are market-ready solutions across every sector from energy, agriculture, building electrification, and industrials (among others), that are both greener and deliver economic ROI to customers. This isn’t environmental altruism—it’s business efficiency.

Talent is migrating to climate en masse. 64% of millennials say they will only work for a business that has a focus on sustainability and impact. Nearly every day our team speaks with someone who is a superstar in their field that wants to apply their talents and experience to climate (and we work hard to place them in our portfolio companies).

Governments are using both carrots and sticks to drive change alongside economic growth. The USA's Inflation Reduction Act alone has ~$380B in incentives to drive over $1 trillion in economic activity. Since 2015, 53% of the world’s GDP has legally committed to net-zero by 2050, with many already implementing carbon pricing.

Consumers are voting with their dollars and companies are listening. More than 63% of Fortune 500 companies have set net-zero by 2050 targets, which is further driving a surge in demand for technologies that measure, reduce and report emissions.

Private capital recognizes the opportunity and exits are starting to accelerate. Since January 2021, $121B has been raised to deploy specifically into climate tech businesses across 207 new funds. Almost concurrently there has been a 70% increase in climate tech exits each year that have disclosed $400B in enterprise value.

Clean Tech 1.0 gets a bad rap for being a dismal failure that most investors try to forget. But the reality is that much of why the circumstances today are so favourably different is because of the gains (particularly in technology and cost) of the predecessor period. We are grateful for the OG generation of Clean Tech because without it we wouldn’t be so well positioned to take on the climate challenge. But this time isn’t a trial run—this time we have to get the job done.

Learning from the VC past, betting on our climate future

The venture capital ‘power law’ describes how a small number of successful companies in a venture portfolio deliver the majority of the fund’s returns. ‘Eight die and two fly’ is the same concept—that most venture investments won’t survive, but very big wins can make up for the losses and generate outsized fund returns.

The venture capital ‘power law’ describes how a small number of successful companies in a venture portfolio deliver the majority of the fund’s returns. ‘Eight die and two fly’ is the same concept—that most venture investments won’t survive, but very big wins can make up for the losses and generate outsized fund returns. Of course in reality, investors don’t know for certain who those winners will be at the outset. We believe in the quality of the team, the size of the market opportunity and the need for the product/customer value proposition for every investment we make—but we don’t go all in on any given company at the initial investment—we wait, observe and support as companies grow and then make follow-on investments when we have conviction that the company is a winner.

Five and a half years into Fund I and two and a half years into Fund II, Active Impact is faced with a relatively unique ‘problem’ for a VC manager: every company we’ve invested in is still operating. We set the big hairy audacious goal that we wouldn’t let any startups fail. We provide active post-investment support (pun intended) to every company and we don’t give up on companies even when times are tough. So how do we continue to serve all founders and important climate solutions in our portfolio while maximizing potential fund financial outcomes?

We’re being strategic about increasing our ownership in portfolio companies as early as possible when we have conviction that the company has unicorn potential. Our average ownership across Fund II companies has increased steadily over the last few quarters and is now 7.4%, and with Fund III we are targeting 10%+. Over the last 3 months, we’ve chosen to be aggressive with three of our portfolio companies and proactively increase our ownership percentage. By being proactive with follow-on investments we are doing everything we can to ensure that when/if a company is a big winner that our investors have enough ownership of the outcome to generate huge returns. As they say, you lose in VC not by having losses in the portfolio, but by not having enough of your big wins.

It’s a challenging economic market, but it’s a more challenging climate reality. The present moment requires guts and rigour. We are confident that we see the best seed stage climate tech deals in the market, and when we see teams with a unique solution gaining momentum we’re leaning in. With over 50% of Fund II still to deploy as follow-on capital into the existing portfolio and the first close of Fund III upcoming, we are being disciplined about how we allocate dollars to ensure we achieve the best financial and impact return possible while also being unapologetically bullish about supporting scalable climate solutions now.

Dirty Talk

If it seems like the recent issues of this newsletter have all relayed some heavy climate news … they have and unfortunately this month is no exception. But, we hope that amidst the alarm, you also glean optimism from the solutions and positive progress being made in climate tech.

If it seems like the recent issues of this newsletter have all relayed some heavy climate news … they have and unfortunately this month is no exception. But, we hope that amidst the alarm, you also glean optimism from the solutions and positive progress being made in climate tech.

July was the "hottest month ever recorded on Earth and likely the hottest in about 120,000 years". July’s record-breaking heat waves in the US Southwest, Mexico, China and around the Mediterranean follow the hottest June ever recorded, and it’s likely that the rest of the year will continue to break records. Climate change is currently mingling with El Niño, which has shifted the Pacific Ocean from a cooling period (La Niña) to a warming period—which is amplified by human-caused warming. So the stark reality is that while July was the hottest period ever recorded, it may actually be the coolest period of what’s to come.

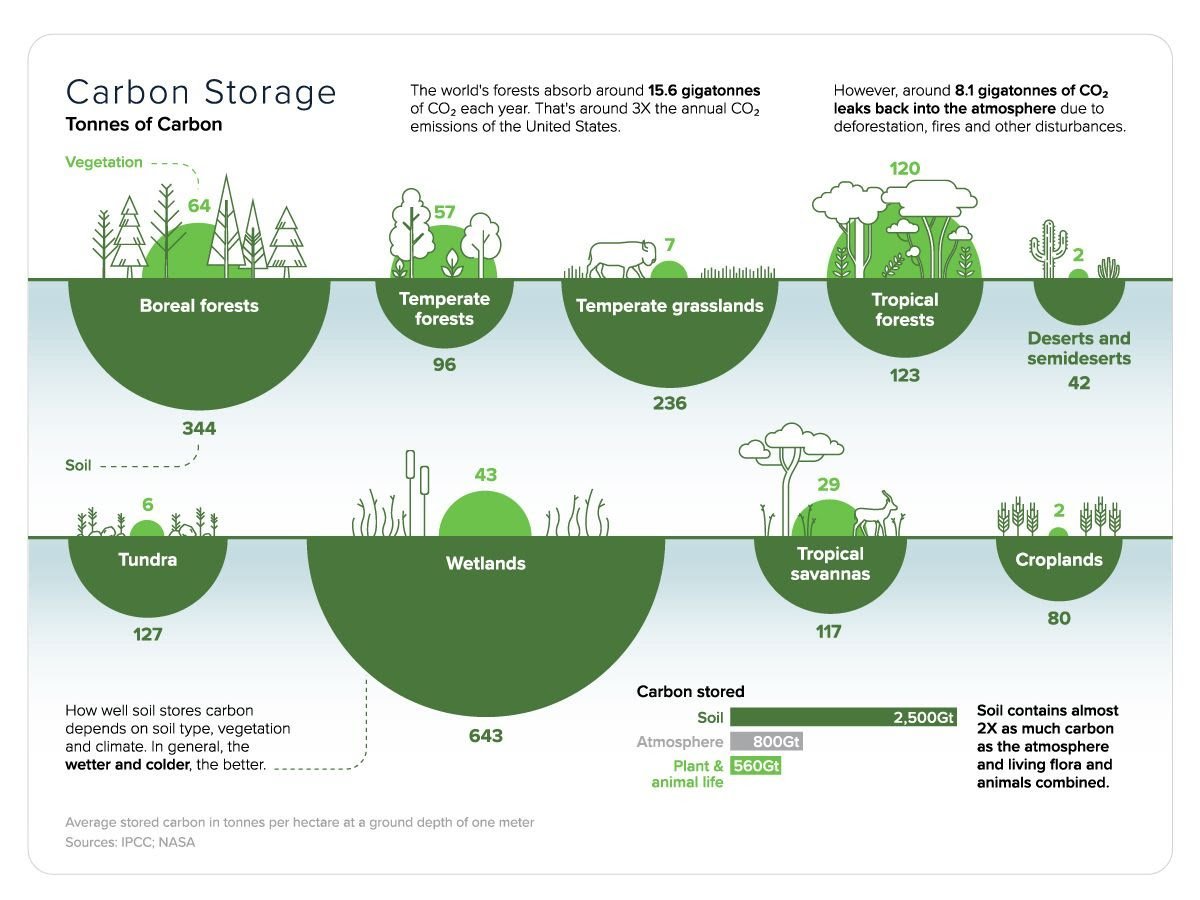

Now for the solutions part. Our portfolio includes (and is seeking) companies that are capable of having a massive, positive climate impact. Our goal is to mitigate 1 million tonnes of CO2 equivalent by the end of this year. But climate tech is only part of the solution—the Earth’s natural systems are the original defense. So let’s take a moment to appreciate soil, which stores 2500 billion tonnes of carbon.

We are actively seeking companies that improve soil health or that catalyze high quality carbon credits (or other incentives to preserve ecosystems), but in the interim we want to do everything we can to keep carbon in the ground, preserve nature and halt record-breaking warming. Earlier this year we launched an Earth Month Challenge to galvanize a donation to the Nature Conservancy of Canada and we’re proud that we catalyzed a $22,000 with Spring Activator and Genus Capital Management. The gift goes towards NCC’s Hastings Wildlife Junction, a 10,000 hectare forest and wetland ecosystem in Southern Ontario that stores 11 million tonnes of CO2e and sequesters an additional 28,000 tonnes every year. It’s a drop in the proverbial bucket, but while heat records continue to be broken we think it’s important to do everything we can and celebrate even a little progress.

Everybody's shufflin' ... North

This past weekend marks celebrations of both Canadian Confederation and American Independence, and while we share good times with family and friends we’re also reflective of the climate forces that don’t give a hoot about flags or national borders.

This past weekend marks celebrations of both Canadian Confederation and American Independence, and while we share good times with family and friends we’re also reflective of the climate forces that don’t give a hoot about flags or national borders. Right now, 80M people in the Midwest are under severe storm threat with many already displaced from flooding, 36M people in Texas are under an extreme heat warning that is putting major strain on electrical grids, and the record-shattering Canadian wildfire season has burned 20M acres and affected hundreds of millions.

Fires and floods displace people and destroy homes. Although these events can be completely devastating, mostly those communities return and rebuild. So what about when the disaster isn’t just a one-time event but a permanent change? Around the world and throughout history, resource scarcity has led to geopolitical upheaval and mass migration–for example, the climate-accelerated stress on freshwater resources that contributed significantly to the sociopolitical conflict in Syria, that has displaced almost 7M people so far. Imagine that, but on a global scale throughout the equatorial region (which happens to be most populous).

The ‘climate niche’ is the set of temperature and precipitation conditions where humanity flourishes. This map shows the temperatures we’re headed towards on our current 2.7 degree warming trajectory, with the shaded area representing temperature rise well above the climate niche. The business-as-usual scenario is 3.5 BILLION people from over 19% of the earth’s surface being displaced by 2070.

But remember, this isn’t an inevitability … yet. Seizing the opportunity to scale climate technology NOW will have the dual benefit of making communities more resilient to extreme weather events, while also keeping the extremes limited to events rather than permanent displacements. The weather news, warnings and broken records are alarming—think of these events as the warning rumbles of what could come in a not so distant future.

50B problem, 50B opportunity

We announced in June that we were going to raise our third fund targeting $120M. Shhh ... there will be a formal announcement in the coming weeks but we want our newsletter subscribers to be the first to hear. For now we can share that we exceeded our goal of 50% toward the final amount and have welcomed an absolutely incredible group of new institutional investors among many returning LPs.

Climate change is at once the most urgent existential threat and the largest opportunity humanity has ever faced. Whether viewed from an economic, geopolitical or scientific perspective, the conditions are present for climate technologies focused on reducing GHG emissions to outperform. There are policy, capital and demand tailwinds that are increasingly driving the adoption of climate technologies. The private investment capital allocated to climate tech companies and the government policy incentives amount to hundreds of billions … and continue to grow. Technologies to mitigate past, present and future emissions exist and are ready to scale.

Humanity emits ~50B tonnes of CO2 equivalent into the atmosphere every year, but in the truest spirit of venture capital—the opportunity is equal or greater than the problem. That’s why we’re excited to announce the launch of Fund III. As Fund II nears a full portfolio, we are preparing for an October first close for Fund III. While the size of the fund will be significantly larger, with a target of $120M, the strategy will be the same. We will continue to find and nurture the best seed stage climate tech companies in North America to facilitate the transition from finite to infinite sources of energy, food, water and products.

Geothermal … so hot right now.

In the world of climate, there are a lot of giant, hairy problems and a lot of “wtf!” moments—but there are also moments when ancient methods meet modern advancement to create opportunities with huge, important potential to mitigate climate change. So let us tell you a little about geothermal energy.

In the world of climate, there are a lot of giant, hairy problems and a lot of “wtf!” moments—but there are also moments when ancient methods meet modern advancement to create opportunities with huge, important potential to mitigate climate change. So let us tell you a little about geothermal energy.

Geothermal harnesses the heat from the Earth's core to generate electricity. The stable, reliable energy is ubiquitously available, requires relatively few resources and has a smaller footprint than other renewable energy sources (3X less than solar and 10X less than wind).

And geothermal is versatile! From electrical power plants, to industrial processes like cement or hydrogen production, to residential heating and cooling—our endlessly giving Earth can provide zero-emission energy on a variety of scales to serve different purposes.

The geology of the Earth's crust can vary greatly from one location to another, and not all areas are suitable for economically feasible geothermal energy production with currently available technology— which makes financing large projects a challenge. Today, only 0.5% of renewables-based installed electricity generation capacity comes from geothermal. But, through the magic of scientific innovation and entrepreneurial guile, recent advances in data analytics and machine learning have made it possible to identify suitable sites more accurately to reduce risk and unlock project financing.

By analyzing data on geological features, temperature, and other factors, companies can make more informed decisions about where to invest in geothermal energy. If companies can unlock a data-based approach to site and technology choice, then we can solve the finance problem and develop geothermal at scale. If you or someone you know is building a company that can advance geothermal, please reach out!

What’s more important than a habitable planet?

The United Nations Intergovernmental Panel on Climate Change released their sixth assessment report in March with a shockingly stark visualization of how different levels of warming will affect those who were born in 1950, 1980 and (importantly) 2020. Mayday! This is not a drill!

The United Nations Intergovernmental Panel on Climate Change released their sixth assessment report in March with a shockingly stark visualization of how different levels of warming will affect those who were born in 1950, 1980 and (importantly) 2020. Mayday! This is not a drill!

To add to the alarm, scientists reported “abyssal ocean overturning slowdown and warming driven by Antarctic meltwater”. Remember the cheesy disaster movie The Day After Tomorrow where an ice age happened over a weekend? It’s that scenario. The Antarctic is melting so rapidly that it is diluting the salinity of the ocean and slowing down the overturning current. This is one of those ‘tipping points’ that scientists have been warning us about—rising sea levels, different weather patterns and mass extinction. If today’s emissions continue, the ocean current will slow down by 40% in only three decades.

You can be forgiven for mistakenly thinking that the darkest scenario depicted in the above infographic is an alarmist worst case scenario. However, it is actually the trajectory we’re on. What is needed, starting today, is a rapid increase in the pace at which new climate solutions are developed and existing climate solutions are deployed. That is the only way to bend the trajectory and reduce (not eliminate, that ship has sailed) the adverse effects of climate change. It is the greatest challenge humanity has faced. It can be done, and must be done if the people alive today are to have a habitable planet. That includes you, your loved ones, and the less privileged people in our global community across the world without the means to cope with even the least drastic changes that are already happening at current warming levels.

We at Active Impact plan to do everything we can to be a part of the solution.

trillion with a “t”

We are climate tech venture capitalists—we invest where technology can transition the world’s resources from finite to infinite. We see opportunity in the decoupling of economic growth from environmental degradation. We believe in markets—in capitalism. So we have to question whether it is fundamentally non capitalistic to subsidize oil and gas to the tune of over one TRILLION USD during their most profitable year ever.

We are climate tech venture capitalists—we invest where technology can transition the world’s resources from finite to infinite. We see opportunity in the decoupling of economic growth from environmental degradation. We believe in markets—in capitalism. So we have to question whether it is fundamentally non capitalistic to subsidize oil and gas to the tune of over one TRILLION USD during their most profitable year ever.

We understand the merit of and celebrate industry profits. Prices went up during a time of lessened global supply and demand remained high. Take climate change out of the equation and it makes perfect economic sense. Last year the largest oil and gas companies made $219B in profit and paid out $110B in dividends and share buybacks. So why is it that during 2022’s record-breaking profits did subsidies (including tax breaks) double … and increase 5X from 2020?

At the same time, many of the largest oil companies reversed their pledges to cut production, transition to renewables and decarbonize. The surge in profits has removed the incentives for the industry to make a clean energy transition. Government subsidies are supposed to be the lever that creates incentives aligned with the public good—not inflating the profits of an entrenched industry whose interests are in conflict with a habitable planet.

What could be further from free market capitalism AND contrary to social/environmental welfare than subsidizing fossil fuel companies during their most profitable period … while at the same time incentivizing those companies to reduce their role in the clean energy transition? Did all that make your brain spin? Us too, because it’s nuts.

The world’s cash has a carbon problem

When we think about corporate carbon emissions, we probably envision a factory, a polluted river or maybe even waste in a landfill. So it may be a surprise to learn that the world’s largest company’s cash and investments generate significantly more emissions than their operations and supply chains combined.

When we think about corporate carbon emissions, we probably envision a factory, a polluted river or maybe even waste in a landfill. So it may be a surprise to learn that the world’s largest companies cash and investments generate significantly more emissions than their operations and supply chains combined. When a company holds cash (A LOT of cash in the case of the world’s largest companies) banks invest that money in energy development, construction projects, loans to other businesses and a multitude of other activities that all generate emissions. These scope 3 emissions have a BIG impact. The Carbon Bankroll Report notes that Apple’s $191M in cash and investments in 2021 generated 14.9M tonnes of emissions — nearly three times larger than the total emissions generated by the use of every Apple product in the world in the same year!

And, it’s not just confined to the cash and investments of large corporations. Pension funds represent ~$47T in capital, of which only 15% have a policy to exclude fossil fuels in some way and 65% have no climate policy of any kind (according to the BBC).

The good(ish) news is that the corporate sustainability movement is gaining momentum. All the companies listed above have made commitments to both net-zero and pathways to 1.5 degrees. Many have also created investment arms focused on climate solutions, like Microsoft’s $1B Climate Innovation Fund for carbon reduction and removal technologies.

Yet, the financial supply chain — despite even the most ambitious climate commitments — is funnelling billions to the industries driving the climate emergency. Since the 2015 Paris Agreement, the world’s 60 largest commercial and investment banks have invested $4.6T in the fossil fuel industry. Companies of all sizes, pension funds and their collective shareholders have a powerful role to play in pushing the financial sector to rapidly decarbonize. The universal language of cash, even passive cash reserves, may be one of the most important ways to mitigate climate disaster.

New Years Resolution: Drop 1M Tonnes

Happy new year! We always enjoy the experience of taking time to look back at what happened last year — it's amazing what you can pack into just 12 months. Following a year of building our team and growing our assets under management by 7X, in 2022 we hit the accelerator with nine new portfolio companies, nine follow-on investments, exit number two, over 50 final pitches to our investment committee and hundreds of other companies evaluated. But the list of transactions only tells half the story.

Happy new year! We always enjoy the experience of taking time to look back at what happened last year — it's amazing what you can pack into just 12 months. Following a year of building our team and growing our assets under management by 7X, in 2022 we hit the accelerator with nine new portfolio companies, nine follow-on investments, exit number two, over 50 final pitches to our investment committee and hundreds of other companies evaluated. But the list of transactions only tells half the story.

We focus our post-investment support on the three areas where we see the greatest need: sales, talent and fundraising. Since our initial investment, our Fund I companies have grown their revenue an average of 9.8X and across both funds we’ve seen an average 20% quarter over quarter sales growth. In 2022, we helped our portfolio companies raise $126M in addition to our investment capital. We built out our recruiting and talent function and have now placed a total of 14 key hires across our portfolio companies, and are proud that 64% of those are female and 36% are sales leaders. We look for ways to put our founders first at every step from screening to support to exit, which is why we're proud that they gave us a 9.6 (out of 10) satisfaction score.

In 2022, global markets were humbling to put it lightly. Every quarter we present an update to our investors and each time we take a sober look at what’s going on at the macro level. This lead to an action plan to help prepare for an expected rough year so we were pleased that each quarter we had multiple up-rounds underway and every one of the 28 companies we’ve invested in is still operating. The positive outlook isn’t just due to us of course, or even the incredible founders that comprise our portfolio — it’s also largely because the world is finally waking up to both the crisis and opportunity posed by climate change. Climate tech has been one of, if not the most insulated sector in this recession with policy tailwinds like the USA's $374B Inflation Reduction Act and the EU’s Carbon Border Adjustment Mechanism. But the excitement of the opportunity is only outweighed by the seriousness of the crisis as shown by the extreme flooding in Pakistan and prolonged, extreme heat and drought in China. So, the accelerator stays pressed and our ambitions stay high — in 2023 our goal is for our portfolio companies to mitigate 1M tonnes of CO2 and equivalents.

Here’s our annual round up of major events:

January

Fund II invests in Tengiva

GoJava follow-on investment

Kelley joins as Operations Coordinator

February

Fund II invests in Optiwatt (lead)

Manifest Climate follow-on investment

Alana joins as Principal

March

Awarded Foresight Canada’s “Cleantech Innovation Funder of the Year”

Therma Bridge to Series A

Sametrica Bridge round

April

Named the “Public’s Favourite VC” on the global Climate50 list

Fund II invests in Sustain.Life

Fund II invests in Flair (lead)

SWTCH follow-on investment

Carbon America follow-on investment

May

Fund II invests in Future

June

Solstice follow-on investment

Aquacycl follow-on investment

July

B Corp recertification with top 10% overall global score

Fund II invests in Metafold (lead)

August

Audette follow-on investment

Keela Bridge round

Therma Series A

September

Fund II invests in King Energy

Sale of Solstice to MyPower Corp.

October

Awarded Canada Clean50 status

Fund II invests in Agrology (lead)

RailVision follow-on investment

November

Clean Crop follow-on investment

ChopValue Series A

December

Fund II makes investment #13 (lead, to be disclosed soon)

Aquacycl Series A

All we want for our sustainable future is…

This month marked the close of COP27 in Egypt, the 27th United Nations Climate Change Conference. The close of COP is always a bit of a high/low in the climate world — high because we have to be optimistic about the progress delivered by the global gatherings, low because there’s usually some counterbalancing force that pulls the progress back.

This month marked the close of COP27 in Egypt, the 27th United Nations Climate Change Conference. The close of COP is always a bit of a high/low in the climate world — high because we have to be optimistic about the progress delivered by the global gatherings, low because there’s usually some counterbalancing force that pulls the progress back. Some good news from this COP is that a final agreement was reached to develop a loss and damages fund whereby the richest countries would compensate developing countries to ease the financial burden of being the most acutely affected by climate disasters … though the most contentious components of the agreement won’t be ironed out until the next COP. It’s also worth noting that there was an explosion in the number of oil and gas lobbyists with 636 in attendance, “a rise of more than 25% from last year and outnumbering any one frontline community affected by the climate crisis,” according to the Guardian.

Al Gore opened the conference and surely many of you (like us) remember the moment you saw An Inconvenient Truth for the first time. Perhaps the film was an awakening for you like it was for many on our team. Just as he did in the 2006 documentary, Gore delivered sobering truth bombs at the conference — including highlighting the 600K Hiroshima bombs’ equivalent of heat that humanity emits PER DAY, backing his claim that we "treat our atmosphere like an open sewer”.

But Al Gore also listed some incredible progress that should be celebrated: 90% of all new energy installed last year was renewable, solar is now the cheapest power in history and renewable energy nets 3X more jobs than oil and gas. The environmental transition underway holds the biggest opportunity ever. The narrative of mitigating and adapting to climate change needs to be about all the benefits — all the cool, star trek-esque progress that will come along with our sustainable future. Our team is especially lucky in that we get to see innovation as part of our everyday business, so we want to share a couple highlights that are especially cool … like a wish list for the net-zero reality that is within reach:

Seaweed supplements that reduce cattle methane emissions

Net-negative concrete made with algae that sucks carbon out of the air

Affordable family cars that have a solar panel shell to self-charge in the sun

Coding seed DNA with sensors so plants can communicate their nutrient needs

3D printing any inventoried part locally and automatically with zero waste

Lab cultivated fungi to break down waste

Symbiotic fungi in tree root systems to increase growth rates

Using microbubbles in farm irrigation systems to more efficiently deliver nutrients

Our first SOCAP in three years

Tom and Mike just got back from the annual SOCAP conference in San Francisco after a three year COVID hiatus. SOCAP is one of the largest conferences in the impact investing/"social capital" world, with over 2000 attending in person and another 2000-ish online. A couple key takeaways from their experience…

Tom and Mike just got back from the annual SOCAP conference in San Francisco after a three year COVID hiatus. SOCAP is one of the largest conferences in the impact investing/"social capital" world, with over 2000 attending in person and another 2000-ish online. A couple key takeaways from their experience:

Impact is (finally) mainstream. There has been huge progress in the impact investment world in the past three years. People no longer need to be convinced that above market returns are possible. People have stopped complaining about a lack of products available in the market. There is general consensus on the role of ESG (defence) vs impact (offence). The money and top talent has flooded in.

Specialization is key. Just like Active Impact Investments made the decision to specialize exclusively in climate tech, most other funds have moved to a singular impact focus. This has caused a healthy splintering away from generalist events to a whole new host of events with deep domain expertise attracting real solutions and those that want to finance them.

GV and SOSV are awesome. In fact, for us they were the best two events. We hosted a small private dinner with Andy Wheeler from GV (formerly Google Ventures) who spoke about his experience in climate related investments and what excites him about the future. I think all the attendees got a lot out of his talk and Q&A because we certainly did. We also attended the SOSV breakfast event where we were inspired by their global approach to solving deep tech climate problems and how they have scaled.

Nothing beats in person. In addition to making new connections, we got to see Orianna pitch our portfolio company Aquacycl on the mainstage and hang out with our Canadian ecosystem friends like InBC, McConnell Foundation, Genus Capital Management, Rally Assets, Good & Well, Raven Indigenous Capital Partners, Renewal Funds, Amplify Capital, Spring Activator, SVX and more.

The best stories are never reported. You will have to call and ask if you want to know about our buffet lunch strategy, the dumpling war, middle aged men sharing a hotel room, where to buy cheap sunglasses and how drinking alcohol can lead to food waste at late night events.

What do EV batteries have to do with Truth and Reconciliation?

From electric cars (EVs) to solar panels — there is a particular cocktail of minerals required by the clean energy economy of the future. The transition is necessary, therefore the resource components are necessary — but where those minerals come from, how they are extracted and who benefits from their extraction really matters.

From electric cars (EVs) to solar panels — there is a particular cocktail of minerals required by the clean energy economy of the future. Production of lithium, nickel, copper, cobalt, and other key minerals will have to quadruple over the next two decades to meet the Paris target of 2°C warming. The transition is necessary, therefore the resource components are necessary — but where those minerals come from, how they are extracted and who benefits from their extraction really matters. This month we’re reflecting on how mineral extraction intersects with Indigenous Rights, Truth and Reconciliation.

See here how EVs and clean power generation compare to their fossil fuel counterparts in terms of mineral requirement. An offshore wind plant today requires 12X more mineral resources than an equivalent gas plant. Source: The Carbon Brief

What’s problematic is that the largest deposits of the most crucial minerals are within Indigenous lands … but more often than not the extraction rights are owned by someone altogether different. Cobalt gets a lot of attention because 70% of the world's supply is in the Democratic Republic of Congo, but 80% of the industrial mines are owned by Chinese companies. A giant storehouse of these minerals lies at the bottom of the Pacific Ocean, but their extraction has unknown, potentially very large environmental consequences. The mining rights on the seafloor deposits have been largely allocated to small island nations who will bear the harshest negative climate impacts — but those rights are being acquired for a fraction of their lifetime value by foreign companies. And here in Canada, a huge, remote area in northwestern Ontario known as the Ring of Fire holds massive deposits of nickel, copper, platinum and palladium underneath an expanse of undisturbed peatland that is storing as much or more carbon than would be mitigated by the EV production the minerals could facilitate. The interests of mining companies and the Ontario government are in legal combat over the Indigenous rights that control the area.

They say history doesn’t repeat but it rhymes. The world is at the precipice of repeating the same colonial, extractive paradigm that defined the fossil fuel age. To facilitate a just and equitable transition to a clean economy, we have to change our thinking about how we consume resources.

The good news is that there are a number of innovators and start-ups deploying solutions that make the use of resources more efficient or completely change the composition of what’s needed EV/battery related issues can be addressed by innovating the battery supply chain:

Redesign without the need for precious metals, like batteries made with seawater or thermal batteries,

Reduce the battery capacity needed like battery swapping or integrating novel solar panels into the design of EVs to charge while driving,

Redeploy used EV batteries for energy storage broadly, and

Recycle materials and responsibly manage batteries at the end of life.

Innovations alone won’t ensure that the value created from mineral extraction is shared equitably, but as impact investors we think deeply about how the companies and industries we invest in can create systemic positive change — for the climate and society. The clean transition is an exceptionally rare opportunity to recalibrate all industries, beyond just climate tech, to make sure we utilize the resources we have in the best way possible and to integrate the values of justice, equity and reconciliation.

What’s a meat lover to do?

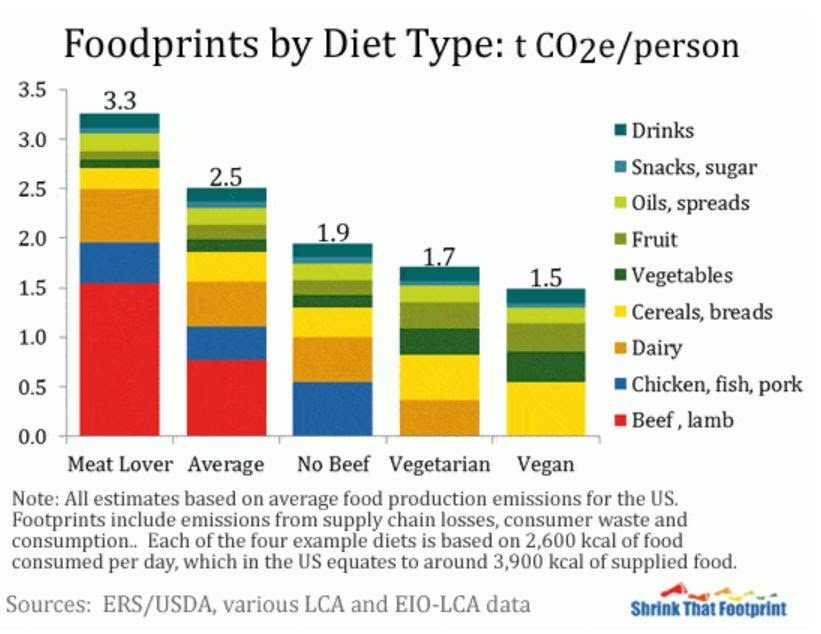

Buckle up because we’re about to ruminate on a pretty contentious topic: meat and climate change. The impact of eating meat as it pertains to climate is clear: there are more greenhouse gas emissions associated with meat calories than plant calories. It’s a huge source of optimism to see the rapid adoption of plant-based diets, and the quality and availability of new alternative product options. But we also recognize that it’s unrealistic to expect the whole world to stop eating meat any time soon.

Buckle up because we’re about to ruminate on a pretty contentious topic: meat and climate change. The impact of eating meat as it pertains to climate is clear: there are more greenhouse gas emissions associated with meat calories than plant calories. It’s a huge source of optimism to see the rapid adoption of plant-based diets, and the quality and availability of new alternative product options. But we also recognize that it’s unrealistic to expect the whole world to stop eating meat any time soon. There are plenty of people, many of our team included, who face the ever-nagging internal conflict of genuinely enjoying meat while still wanting to make environmentally positive choices.

It can be debilitating to consider the climate in every consumer choice we make — especially one as important and pervasive as diet. The food system accounts for about 25% of all global emissions, 14-15% is from agriculture and half of that is directly from livestock … and 75% of all livestock emissions are from cattle. Cattle need 28X more land, 11X more water than pork or chicken and are the single largest source of methane, which is 80X more warming than CO2. Not to mention the tangential effects of deforestation, water table contamination, antibiotic resistance, pesticides and soil erosion. Yikes, that's a high price to satisfy that Big Mac craving.

There are nuances in land management and grazing cattle can (when done regeneratively) actually sequester carbon — but that is not what’s happening in your conventional grocery store or between fast food buns.

Another nuance worth mentioning is the $38B+ that the US government spends on subsidizing the meat and dairy industry each year. These subsidies help the meat industry stay profitable while continuing to incentivize meat consumption by keeping consumer prices low. The real, raw price of a pound of beef without these subsidies is estimated to be $30 – much steeper than a lot of us are willing to pay.

So what’s the easiest way to get 90% of the climate benefit with 10% of the sacrifice? When you do decide to eat meat, have a smaller portion size and ensure none on the table goes to waste. Don't eat meat with every meal so it becomes a treat/luxury and recognize that the climate cost of a ‘meat treat’ isn’t flat, as not all meat is created equal — cow products (that’s you too, dairy) are by far the worst climate offender. Eating more plants is a hugely positive choice, but strictly limiting beef and dairy in favour of other meats is as well. The privilege of having so many options in our grocery stores comes with the responsibility of making informed decisions – and luckily, lab grown meat and alternative meat and dairy products are becoming more available, more delicious and cheaper! We believe that in the near future eating less meat and choosing alternative proteins won’t be a sacrifice … it will be a staple and meat will be seen as the luxury it very much is.